Build a Deep Learning Model to Predict whether a Borrower will Payback Loan or Not

LendingClub is a US peer-to-peer lending company, headquartered in San Francisco, California. It was the first peer-to-peer lender to register its offerings as securities with the Securities and Exchange Commission (SEC), and to offer loan trading on a secondary market. The historical data on loans given out with information on whether or not the borrower defaulted (charge-off). The goal is to build a model that can predict whether or nor a borrower will pay back their loan. This way in the future when it can be assessed a new potential customer whether or not likely to pay back the loan.

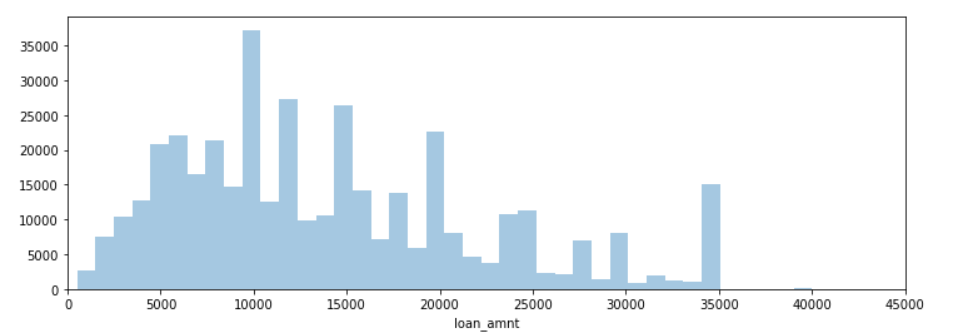

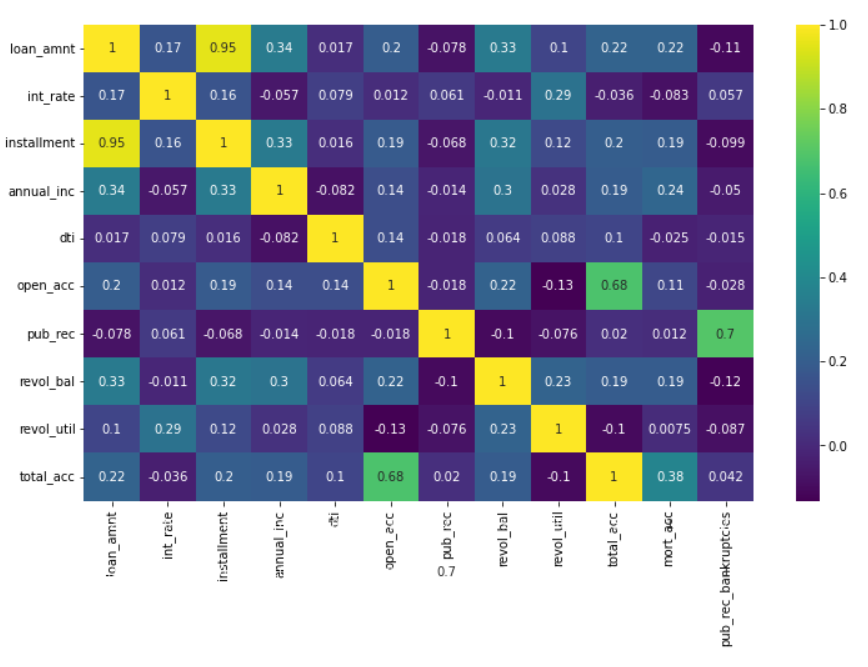

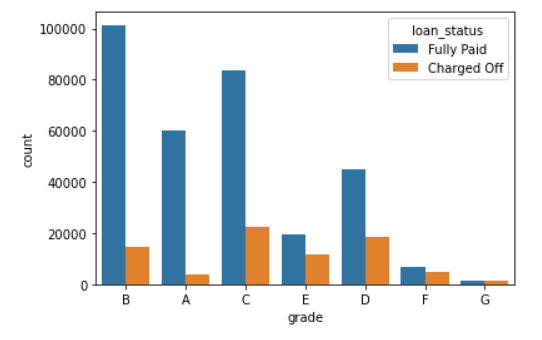

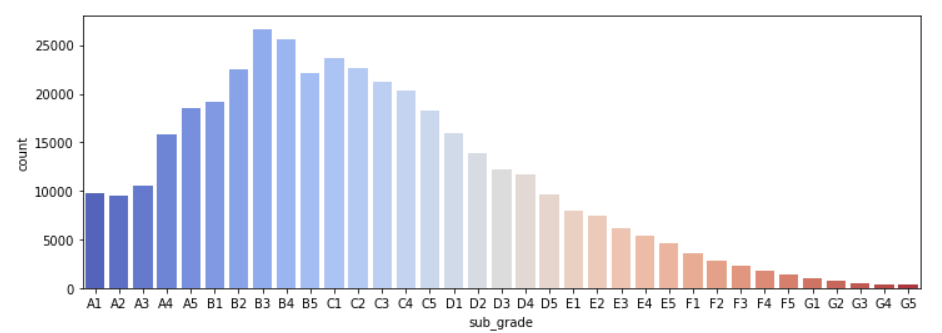

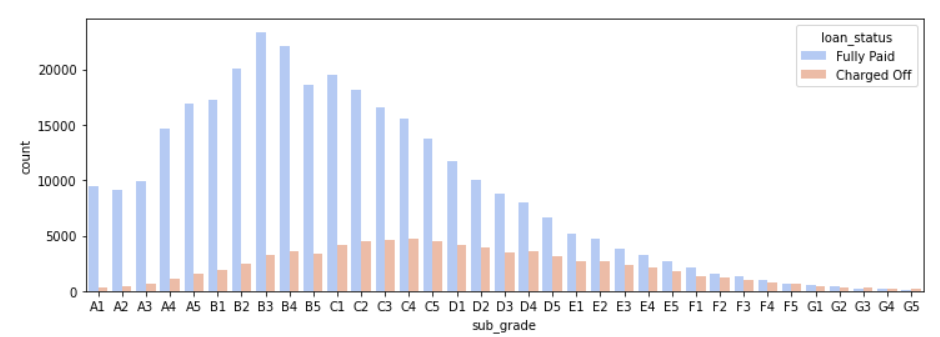

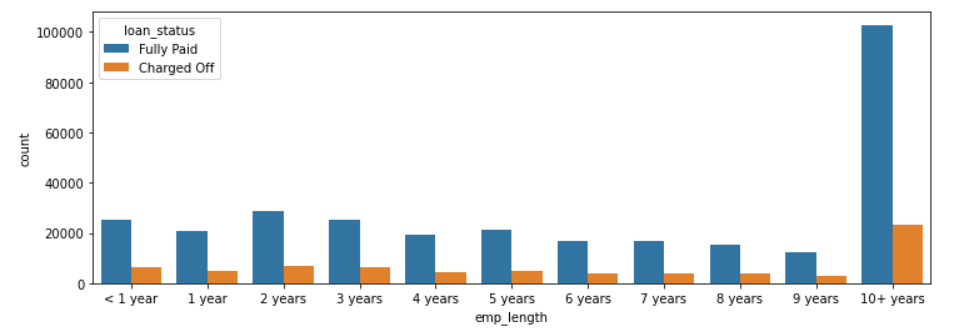

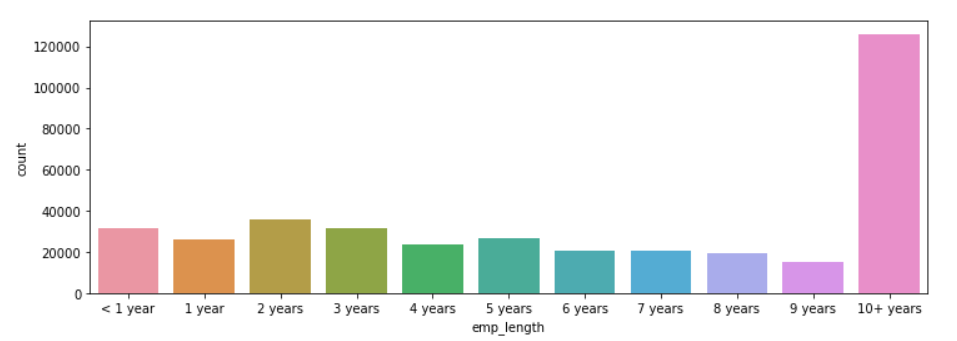

- Exploratory Data Analysis: Get an understanding for which variables are important, view summary statistics, and visualize the data

- Data Pre-Processing: a) Remove or fill any missing data, b) Remove unnecessary or repetitive features, c) Convert categorical string features to dummy variables.

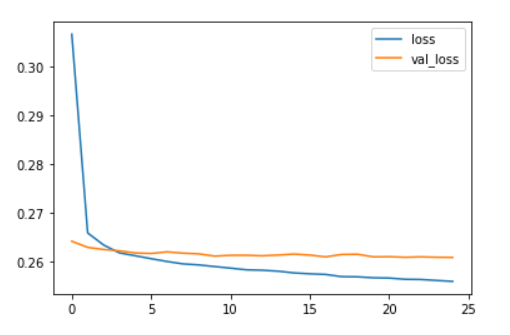

- Creating the Model using TensorFlow

- Classification metrics used to evaluate the model performance